Green Buildings Tool

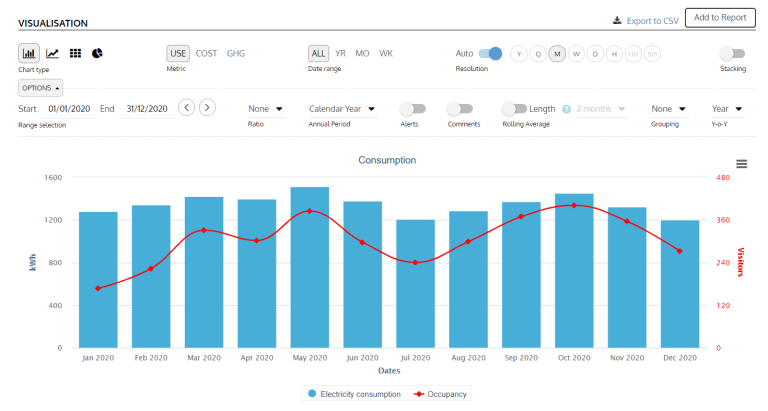

Problem Addressed

The built environment is directly responsible for 25% of UK emissions, lifting to 42% if you include surface transport. By combining public data with expert consultancy, this tool offers an all-in-one platform for tenants, owners and investors to make their buildings or portfolios more sustainable to mitigate their contribution to this problem.

Case Study

CFP are running the second year of their partnership with Lloyds Bank. Highlights so far have been improved risk management and reporting on their commercial and social housing real estate portfolios while engaging over the topic of sustainability with hundreds of clients.

This page presents data, evidence, and solutions that are provided by our partners and members and should therefore not be attributed to UKGBC. While we showcase these solutions for inspiration, to build consensus, and create momentum for climate action, UKGBC does not offer commercial endorsement of individual solutions. If you would like to quote something from this page, or more information, please contact our Communications team at media@ukgbc.org.

Related

A smart socket to reduce emissions

BlockDox

Fabriq OS

arbnco